How WhatsApp Business API is Enhancing the Banking Sector

Discover how the WhatsApp Business API is transforming the banking sector by enhancing customer service, streamlining operations, and offering secure, convenient solutions.

The banking and financial sector has been using technology for many years to improve customer service and operations. WhatsApp Business API allows instant communication. The API allows real-time communication between banks and clients while maintaining a reliable, secure, and efficient communication channel. This article explores the benefits and use cases of WhatsApp API in banking and financial sector.

What is WhatsApp Business API?

WhatsApp Business API allows businesses to integrate powerful messaging into their existing systems. It will allow automated and real-time communication with customers. The API was created to meet the needs of medium and large businesses. The WhatsApp Business App is only available for small businesses.

Key features of the WhatsApp Business API include:

- Chatbots automate the sending of messages.

- Support encryption and security of real-time clients.

- We are integrating CRM software with other business applications.

- The scalability of the system allows thousands of customer interactions to be handled simultaneously.

WhatsApp Business API lets you send transaction alerts, OTPs, and notifications. By providing a conversational interface, businesses can better engage their customers. This platform is especially useful for financial institutions, as it improves communication and customer service while also securing transactions.

Top 5 Benefits Of Whatsapp Business Api For Banking & Finance

Adoption of WhatsApp API in the banking and financial sector can have several benefits, including improved operational efficiency and customer service. Here are five of the benefits.

Customer Service

WhatsApp is an excellent way to connect with your customers. Many prefer WhatsApp to other communication methods, such as telephone and email. Banks that are quick to respond to customers' questions and concerns will have more satisfied clients. Live agents and chatbots are available to help customers 24 hours a day.

Improved Security

WhatsApp API allows for end-to-end encryption of financial transactions. This ensures that sensitive information, such as OTPs and account numbers, is transmitted securely. Banks can use two-factor authentication to enhance transaction security.

Cost-Efficient Operation

WhatsApp Business API can automate your customer service, reducing the size of your team and costs. Chatbots can handle simple tasks like balance checks, transaction notifications, and loan applications, which can reduce operational costs. By automating, call centers can focus on more complex problems.

Faster Response Time

WhatsApp's real-time capabilities enable banks to respond to customer questions almost immediately. The banks can answer any question from a customer, whether they want to confirm a transaction or learn more about an upcoming event. The overall customer experience is improved. APIs can be used for proactive communication, such as informing customers about important updates or reminding clients of their bills.

Personalized Customer Interaction

WhatsApp API provides a more personalized communication experience. Banks can provide customized offers or investment opportunities to their customers. By tailoring their services to customer preferences and behavior, financial institutions can improve their relationship with customers.

How Does the WhatsApp Business API Work for Banking?

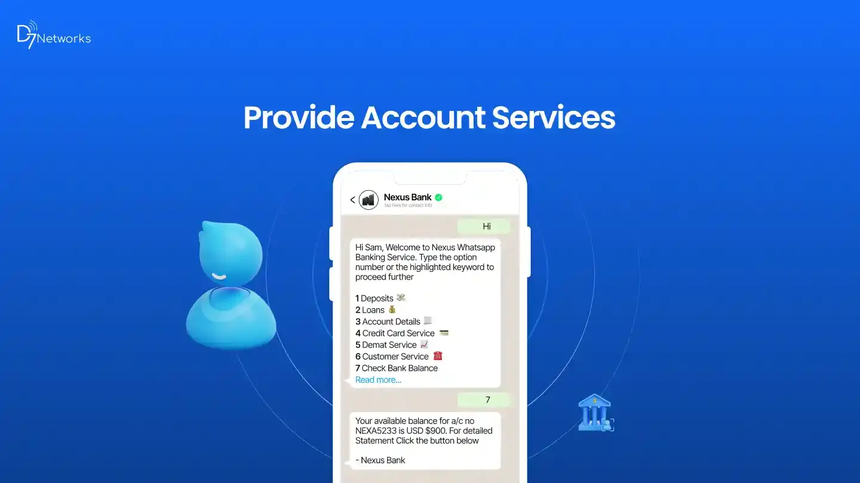

1. Provide Account Services

WhatsApp Business API lets banks offer various account services via the chat interface. Customers can check their account balance, view recent transactions, request mini-statements, or transfer funds in a familiar, secure environment. This convenience increases customer engagement and satisfaction.

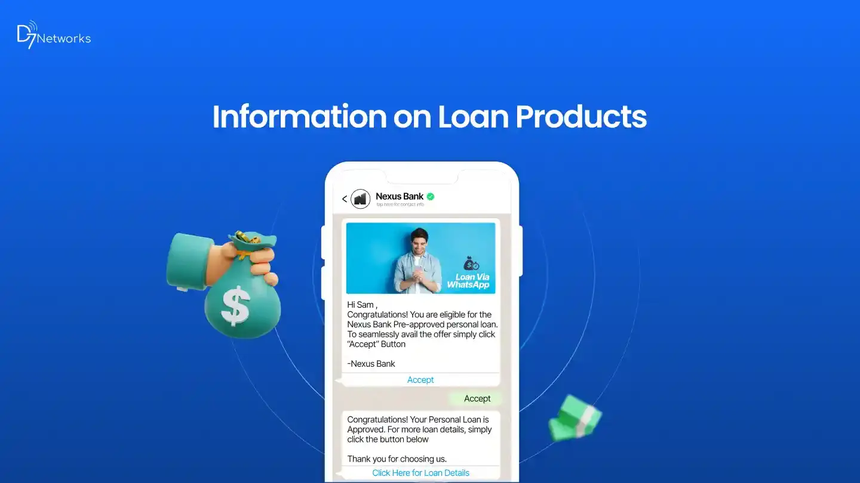

2. Information on Loan Products

By utilizing WhatsApp API, banks can offer instant, personalized support and secure communication for loan products. The interest rates and other FAQs can be easily handled through the chat surface. Banks can also send real-time updates about loan applications through WhatsApp API. The targeted promotional messages can be sent with rich, interactive content.

3. Information on Deposit Products

The banks can give you information about the different deposit schemes that they offer. These include savings, recurring, and term deposits. The banks will provide information about the features and rates of their deposit schemes.

4. Instant Account Openings

The WhatsApp API makes it easier to open instant accounts by providing instant communication and automated support. Customers can inquire about account features, eligibility, and requirements at any time, and securely upload necessary documents through WhatsApp. The API provides real-time updates on the application status and offers personalized guidance throughout the process.

5. Send Reminders: Stay Connected

Keep customers informed about their accounts. WhatsApp Business API allows banks to send automated notifications about upcoming EMIs or credit card statements, as well as bill payments. These reminders help customers manage their finances better.

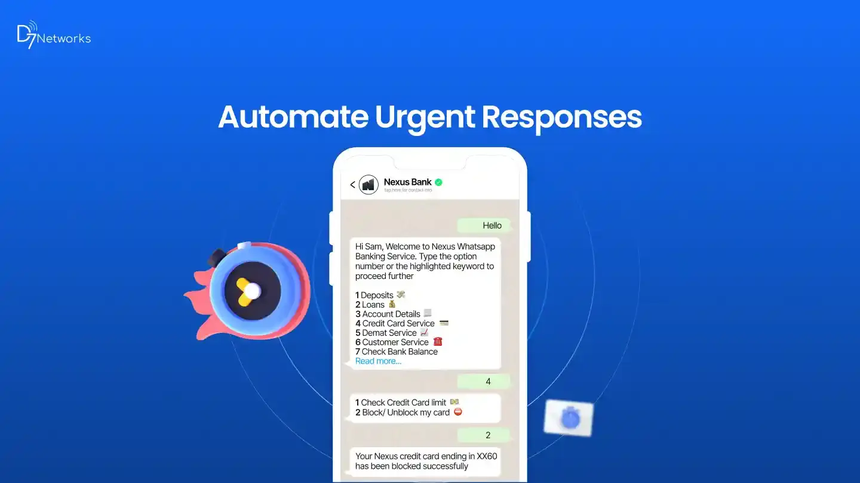

6. Automate Urgent Responses

In scenarios where immediate attention is required, such as reporting a lost or stolen card, WhatsApp Business API can automate urgent responses. Customers can instantly block their cards or receive guidance on next steps, minimizing potential losses and providing peace of mind.

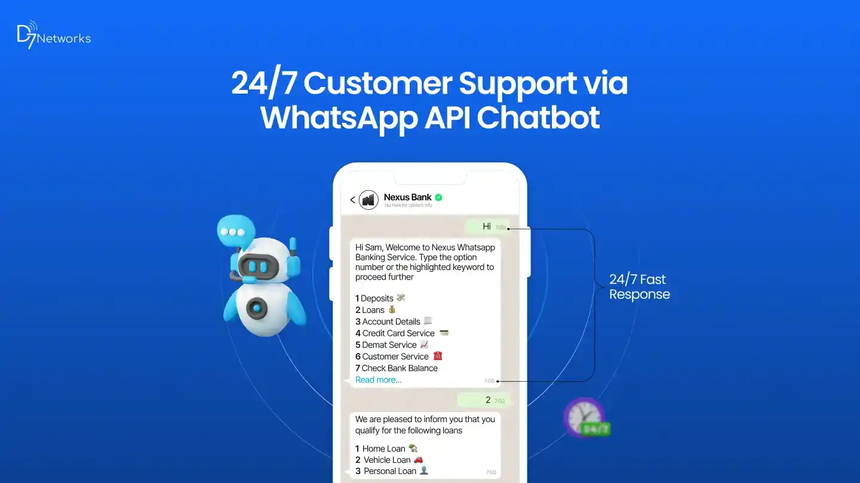

7. 24/7 Customer Support via WhatsApp API Chatbot

Chatbots that are integrated with WhatsApp Business API enable banks to provide 24/7 customer service. These chatbots can handle a variety of questions, from simple inquiries about balances to complex queries about loan products.

8. Automate FAQs: Reduce Operational Load

Banks receive numerous routine queries daily, such as questions about interest rates or account features. Banks can automate answers to frequently asked questions via WhatsApp, reducing their operational burden. Automated responses enhance customer service because they ensure that customers receive immediate answers.

9. Gather Customer Feedback

Feedback from customers is crucial for continual improvement. Banks can use WhatsApp to collect feedback on their services and identify areas for improvement. WhatsApp's immediate nature makes it an ideal way to gather real-time feedback.

10. KYC Services: Streamline Compliance

KYC processes can be cumbersome for customers and banks. WhatsApp Business API simplifies these processes, allowing customers to submit KYC documents through the app. Automated verification can speed up approval and ensure Compliance with normal delays.

11. Marketing and Promotions

WhatsApp is an excellent platform for marketing. Banks can use it to send targeted messages or share information about new products. They can also provide tailored financial advice. WhatsApp's high rate of engagement ensures that these messages reach the intended audience.

Get Started with WhatsApp API Integration

Conclusion

The WhatsApp Business API revolutionized how financial institutions and banks communicated with their customers. The API improves customer satisfaction by automating real-time communication and helps to reduce costs. WhatsApp API provides powerful features to banks, such as instant notifications, secure OTPs, and instant notifications.

Adopting new communication technologies like the WhatsApp API is important to stay competitive and satisfy the digitally savvy customer.

D7 Networks WhatsApp Business API allows banks to maximize their potential with WhatsApp.