Power Up Your Banking Security with SMS OTP Verification

Explores the intricacies of OTP, its functionality in banking, and why it's indispensable for mobile banking security.

In the modern world of technology in which mobile and online banking has become the norm security of your transactions in the financial sector is more essential than ever. One of the more efficient ways to safeguard your money are SMS OTP (One-Time password) verification.

What is OTP?

OTP is an individual, temporary code that is generated for every login session or transaction. Contrary to static passwords which are constant, OTPs are dynamic, making sure that even if someone gets your login credentials, they will not be able to log into your account without having the unique code.

How Does OTP SMS Work for Banking?

- Transaction Initiation: When you start a bank transaction or log into your mobile or online bank accounts, the bank asks you to enter your username as well as your password.

- OTP Generation The system generates a random OTP and then sends it to your mobile number by SMS.

- Verification: You input the OTP you received OTP in the appropriate field within either your bank's app, or on the website.

- The transaction is completed: When your OTP is the same as the one that is generated through the program, then the transaction is processed and your account is opened safely.

Why is OTP Essential for Mobile Banking Security?

- Increased security: OTPs offer an added layer of security that makes it much harder for unauthorised users to access your account, even though they have login credentials.

- Real-time Verification OTP: The OTP can be created and transmitted right away upon transaction completion making sure that it is current and valid for the particular time.

- It's easy: OTPs are easy to utilize and are quickly input on mobile devices and are a great security measure.

- Reduced Risk of Fraud By having to require OTP authentication, banks will greatly reduce the likelihood of fraud, for example, unauthorized transactions and identity theft.

Benefits of OTP SMS

AN SMS-based OTP (One-Time Password) is a straightforward but secure security measure that is now an integral part of banking online and other transactions. It comes with a number of advantages which make it a useful security measure to protect users' accounts:

- Secured OTPs: are unique time-limited codes delivered directly to the user's mobile. This makes them extremely difficult to duplicate or intercept because they're only valid for one session.

- User-friendly: A majority of users have a smartphone and SMS OTP is an efficient and easy method of authentication.

- Security: OTPs are typically delivered within a matter of minutes, providing an easy user experience. Customers can request a brand new OTP in case they don't receive the first code.

- Flexibility: OTPs can be used to serve a myriad of reasons such as resets of passwords, logins to accounts and authorization for transactions.

The Role of OTP SMS in Banking Security

In the banking sector security is of paramount importance. SMS OTP plays a crucial function in protecting online transactions. It does this by:

- Avoiding Phishing Attacks OTPs assist in verifying legitimacy of the user, which makes it harder for scammers to trick users into giving out personal details.

- Protection against SIM Swapping by insisting on OTPs to secure transactions banks can reduce the threat of SIM swapping, which is when fraudsters take control of the user's number in order to steal OTPs.

- Addressing Android Platform vulnerabilities OTPs are a good way to safeguard against malicious applications which may try to take SMS messages.

- Reduced Telco Infrastructure Risks: While SMS messages are generally secured, OTPs can help reduce the possibility of intercepting or unauthorised gain access to SMS messages.

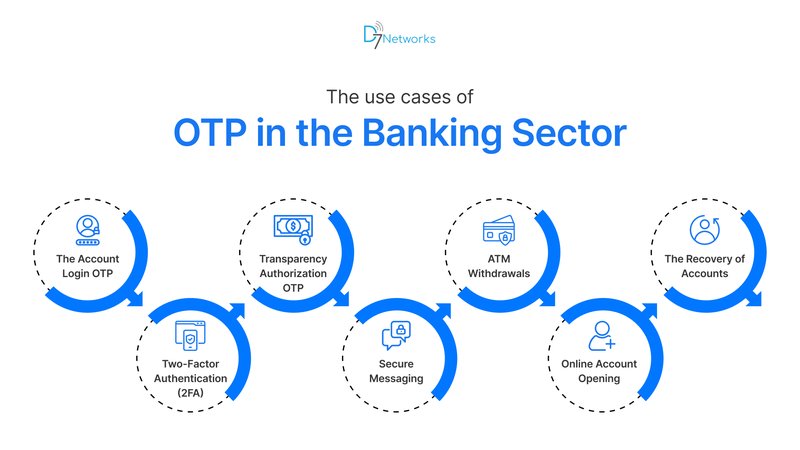

The use cases of OTP in the Banking Sector

- The Account Login OTP will authenticate the user when they sign into their mobile or online bank accounts. By requiring that users use a one-time password along with their password and username, banks will be able to ensure that only authorized people have access to account details.

- Transparency Authorization OTP typically is required in order to approve transactions with high value or certain kinds of financial transactions, like payment of bills, fund transfers or the creation of new beneficiaries. This extra layer of security assists in preventing fraudulent transactions and lowers the chance of fraud.

- ATM withdrawals using cardless technology: Some banks allow ATM withdrawals using cards which allow customers to withdraw cash at ATMs using their mobile phones instead of debit cards. OTP authentication is usually required for the transaction, which ensures that only the authorized account holder has access to the money.

- The Recovery of Accounts. If an account holder loses their password or is blocked from their accounts, OTP could be utilized to aid in the process of restoring their account. By sending an one-time password to the registered email address or mobile number banks are able to verify the identity of the user and aid in the password reset process in a secure manner.

- Two-Factor authentication (2FA): OTP is frequently used as part two-factor authentication (2FA) method, in which users need to provide an item they are familiar with (e.g. the password) and a physical item (e.g. phone, mobile phone) to gain access to their accounts. This multi-layered method improves security and minimizes the threat of unauthorised access.

- Secure messaging: banks can make use of OTP for secure messaging or other notifications to customers, for example notifications about activity on their accounts transactions, transaction confirmations, or promotions. By confirming the identity of the receiver by using OTP banks can be sure that confidential information is transmitted in a secure and reliable manner.

- Online Account Opening: When opening a brand new financial account with a bank or applying for specific services in the financial sector online, OTP may be required to confirm the identity of the person applying and stop identity theft as well as fraudulent applications.

Incorporating OTP SMS into their security procedures, banks are able to greatly enhance the security of the accounts of their customers and decrease the chance of fraudulent transactions.

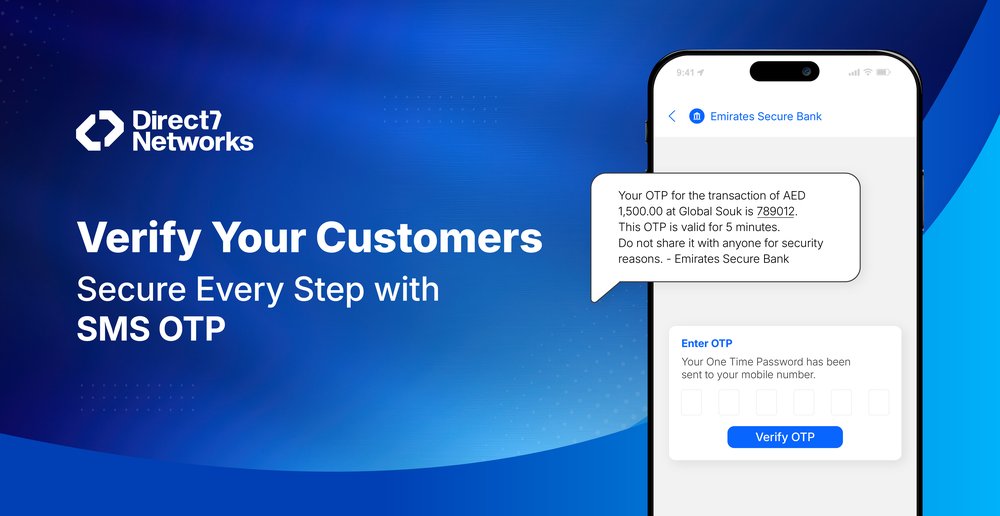

OTP Example SMSs from banks

Here are a few illustrations of OTP SMS messages banks often send:

A one-time password (OTP) to complete your transaction.

- Example : The OTP for the transaction of Rs 10,000 will be 123456.

- Example: OTP for your UPI payment of Rs 500 is 7890.

OTP to confirm your account.

- Example: The OTP to confirm your account is 987654.

- Example: OTP for account verification is 3210.

OTP to log in or for password reset.

- Example: OTP for login is 4321.

- Example: OTP for password reset is 0987.

OTP to activate your card or replacement.

- Example: OTP for card activation is 6543.

- Example: OTP for card replacement is 2109.

OTP for international transactions.

- Example: OTP for your international transaction of $500 is 8765.

- Example: OTP for your international transaction is 1234.

Challenges and Considerations for OTP SMS

Security:

- Attacks using phishing: Scammers often use OTPs to trick users into divulging sensitive data.

- Sim swapping: is a way for attackers are able to take over a phone number to get OTPs, and access accounts.

- Man-in the-middle attacks: Interception of OTPs could lead to an unauthorised access.

User Experience:

- OTP fatigue: Numerous OTP calls can prove a hassle for users.

- OTP delivery issues Issues with network connectivity or inaccurate telephone numbers may hinder or even stop OTP delivery.

- OTP expiration date: Time restrictions may limit the usefulness of OTPs.

Regulatory Compliance:

- Regulations on privacy of data Banks must abide by regulations on protection of data when handling OTPs.

- Standards for authentication: OTPs must meet security and authentication standards.

Technical Considerations:

- Integration with other systems: OTP production and distribution should be synchronized with the existing banking systems.

- The ability to scale: OTP Systems must be able to handle massive volumes of transactions and users.

- Security measures: encryption and other security measures need to be put in place to safeguard OTPs.

Best Practices:

- Multi-factor authentication: Mix OTPs with other methods of authentication (e.g. biometrics, biometrics, Security questions).

- Delivery confirmation via SMS: Check OTP delivery to ensure that there is no an unauthorized access.

- OTP expiration times: Establish acceptable expiration dates for OTPs.

- User education: Help users learn on OTP security and phishing threats.

- Audits of security regularly: Conduct periodic security checks on OTP systems.

- Conformity with regulations: Check for that you are in compliance with the applicable data security and privacy regulations.

Integrate with D7 Verify API for reliable, quick delivery of OTP.

Conclusion

D7 Networks offers a robust OTP Verification that provides enhanced security of online banking. With a secure and easy authentication method, D7 Networks helps protect against fraudulent and unauthorised access actions, providing a secure and secure digital banking experience.

Frequently Asked Questions ( FAQ's )

In banking systems, an OTP (one-time password) is a temporary code sent to the customer's registered mobile number or email. To increase account security to verify transactions login or sensitive functions..

Banks use SMS to update transaction notifications. Balance updates, OTP verification, promotional offers Fraud detection Customer service information and improve safety..

The SMS OTP solution provides a secure, time-sensitive code through text messaging that authenticates users during online banking transactions. Attempting to log in and activities related to the account Helps ensure better safety and compliance..