SAUMYA

Top 8 Use Cases of SMS in the Financial sector

Explore the top impactful use cases of SMS in finance, from account balance inquiries to fraud detection mechanisms. Learn how SMS revolutionizes accessibility, security, and convenience in banking services

Mobile banking is becoming increasingly popular as more and more people rely on their mobile devices for everyday activities. It allows customers to conduct financial transactions through a mobile device, such as a smartphone or tablet.

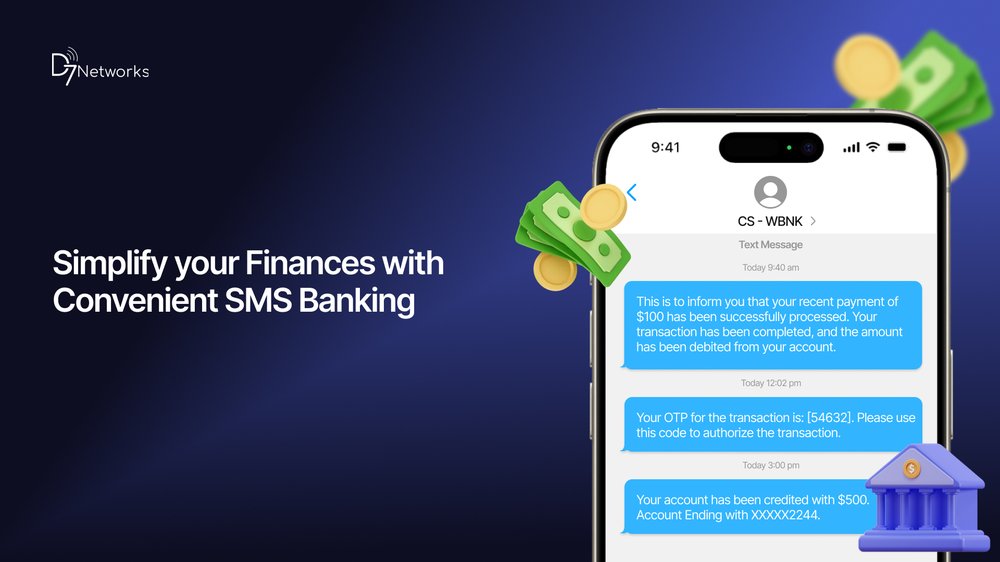

SMS (Short Message Service) is a popular means of communication that has gained widespread use in banking and financial institutions, It is an essential tool for financial institutions to provide quick, efficient, and convenient banking services to their customers. It involves the use of text messages to facilitate banking transactions, alert customers about their account balances, and provide other financial services. It is particularly useful for customers who live in areas with limited internet access or have basic mobile phones that do not support mobile banking apps.

The Use Cases of SMS Banking

1. Account Balance Inquiry

Customers can send a text message to the bank to check their account balance.

2. Transaction Alerts

Customers can set up alerts to receive text messages for each transaction on their account, including deposits, withdrawals, and purchases.

3. Fund Transfer

Customers can send a text message to transfer funds between their accounts or to another account.

4. Account Statement

Customers can request their account statement by sending a text message.

5. Card Blocking:

Customers can block their debit or credit card by sending a text message in case of theft or loss.

6. Account Opening

Customers can initiate the account opening process by sending a text message with their personal information.

7. Authenticated Financial Transaction

The bank can authenticate and verify the customer by sending an OTP SMS to their mobile number, thereby preventing fraud.

8. SMS for Fraud Detection

SMS can be used to lower credit card fraud. Some of the services include SMS notifications for card transactions, SMS notifications for card anomalies (as identified by the fraud system), and SMS confirmation of transactions

Benefits of SMS Banking

SMS banking offers several benefits for customers, including:

- Convenience: SMS banking allows customers to access essential banking services from their mobile phone without the need for internet connectivity or a smartphone.

- Accessibility: SMS banking is accessible to anyone with a basic mobile phone and a valid account with a bank that offers SMS banking services.

- Speed: SMS banking is a quick and efficient way to access banking services, as customers can perform basic transactions with just a few clicks on their mobile phones.

- Security: SMS banking uses encryption and secure channels to protect customer information and transactions, providing a safe and secure banking experience.

- Cost-effective: SMS banking is often free or available at a lower cost than other banking services, making it an affordable option for customers.

- Real-time notifications: Customers can set up alerts for transactions, which provide real-time notifications and help prevent fraud and unauthorized transactions.

D7 networks SMS API offers an instant delivery of your SMS which may contain sensitive information like an OTP. It has a high delivery rate and is affordable.